Simplify Your Finances: How to File Your Online Income Tax Return in Australia

Filing your on the internet tax return in Australia need not be a difficult task if approached systematically. Recognizing the ins and outs of the tax obligation system and effectively preparing your files are crucial initial steps.

Understanding the Tax System

To navigate the Australian tax obligation system effectively, it is important to comprehend its fundamental concepts and structure. The Australian tax obligation system operates on a self-assessment basis, suggesting taxpayers are in charge of precisely reporting their revenue and computing their tax responsibilities. The main tax obligation authority, the Australian Taxes Workplace (ATO), oversees conformity and imposes tax obligation laws.

The tax system makes up various parts, consisting of revenue tax obligation, products and solutions tax (GST), and resources gains tax (CGT), to name a few. Private revenue tax obligation is dynamic, with rates boosting as income rises, while company tax rates vary for small and large companies. Additionally, tax offsets and deductions are available to minimize gross income, allowing for even more tailored tax obligations based on individual circumstances.

Understanding tax obligation residency is additionally important, as it identifies a person's tax obligation responsibilities. Homeowners are exhausted on their worldwide earnings, while non-residents are only strained on Australian-sourced revenue. Experience with these principles will equip taxpayers to make enlightened decisions, ensuring conformity and possibly maximizing their tax obligation results as they prepare to file their on-line tax returns.

Preparing Your Documents

Collecting the required papers is a vital action in preparing to file your online tax return in Australia. Correct paperwork not just improves the declaring procedure however additionally ensures precision, decreasing the threat of mistakes that can cause fines or delays.

Begin by gathering your income declarations, such as your PAYG settlement summaries from employers, which detail your profits and tax obligation kept. online tax return in Australia. If you are independent, guarantee you have your organization earnings documents and any kind of appropriate invoices. In addition, gather financial institution declarations and paperwork for any type of interest earned

Next, put together records of deductible expenses. This might consist of receipts for job-related expenses, such as uniforms, traveling, and devices, in addition to any kind of instructional expenditures associated with your occupation. If you own building, guarantee you have documentation for rental revenue and connected expenses like repairs or property management fees.

Don't fail to remember to include various other appropriate documents, such as your medical insurance details, superannuation payments, and any kind of investment earnings declarations. By thoroughly organizing these documents, you establish a strong foundation for a efficient and smooth on-line income tax return procedure.

Choosing an Online Platform

After organizing your paperwork, the next step includes choosing an appropriate online system for submitting your tax obligation return. online tax return in Australia. In Australia, numerous trustworthy platforms are readily Your Domain Name available, each offering distinct features customized to different taxpayer demands

When selecting an on-line platform, think about the individual interface and convenience of navigation. A simple layout can substantially boost your experience, making it easier to input your details accurately. Furthermore, make certain the platform is compliant with the Australian Taxes Office (ATO) guidelines, as this will certainly guarantee that your submission satisfies all lawful requirements.

Systems have a peek at this website using online talk, phone assistance, or comprehensive FAQs can provide beneficial aid if you run into challenges throughout the filing process. Look for platforms that utilize encryption and have a strong privacy policy.

Lastly, take into consideration the expenses connected with different platforms. While some might use totally free solutions for basic income tax return, others might charge fees for advanced functions or additional assistance. Consider these factors to choose the system that aligns best with your financial scenario and declaring requirements.

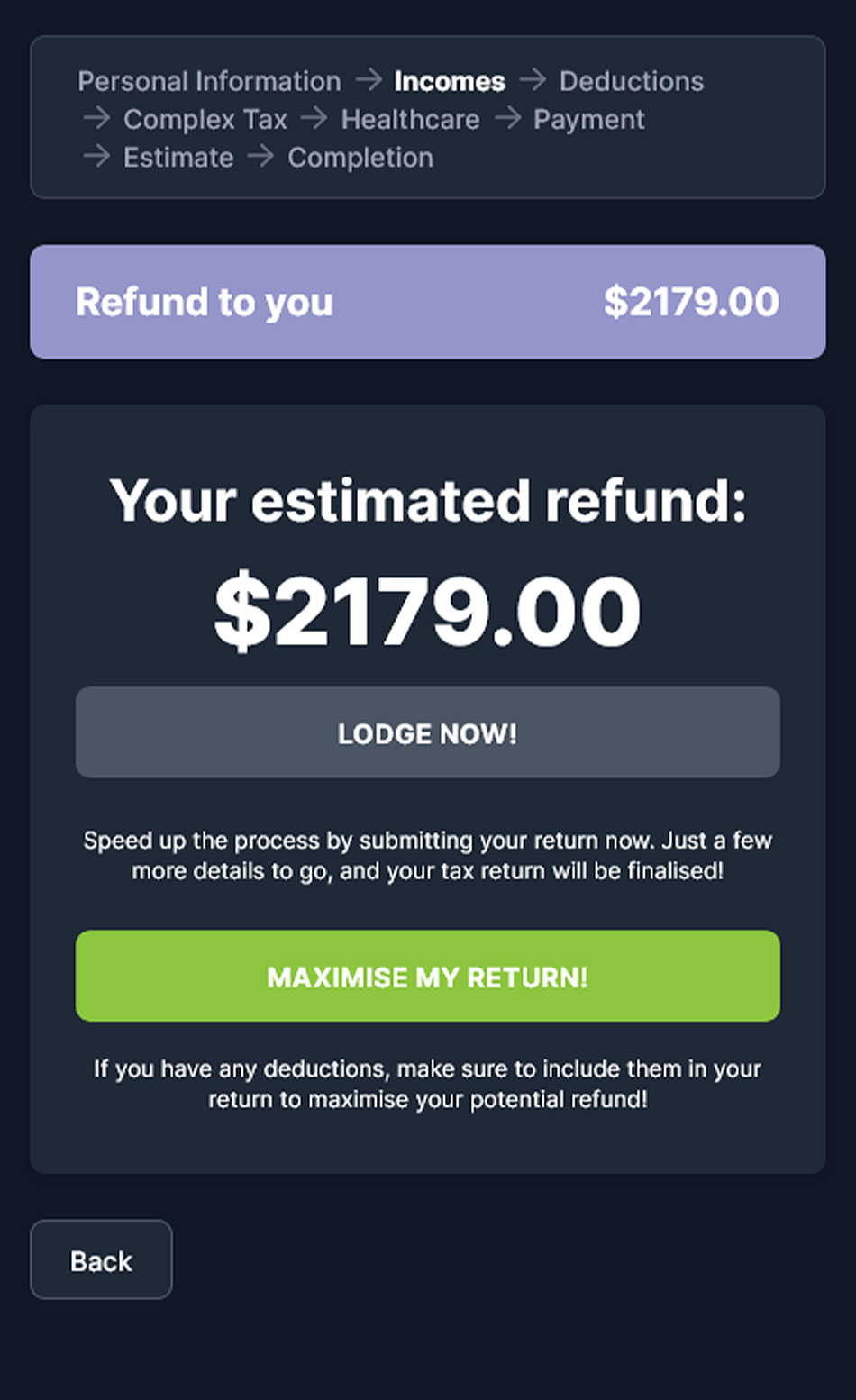

Step-by-Step Filing Process

The step-by-step declaring procedure for your on-line tax obligation return in Australia is developed to simplify the submission of your economic information while making sure conformity with ATO laws. Begin by collecting all necessary documents, including your income statements, financial institution declarations, and any type of receipts for reductions.

When you have your files prepared, log in to your picked online platform and produce or access your account. Input your individual information, including your Tax File Number (TFN) and call details. Next, enter your earnings information properly, ensuring to include all resources of earnings such as incomes, rental revenue, or investment profits.

After outlining your revenue, go on to assert eligible reductions. This may consist of job-related costs, charitable contributions, and medical expenditures. Make certain to examine the ATO standards to optimize your insurance claims.

After ensuring whatever is correct, submit your tax obligation return online. Check your account for any updates from the ATO concerning your tax obligation return condition.

Tips for a Smooth Experience

Completing your on-line income tax return can be a simple process with the right preparation and way of thinking. To make sure a smooth experience, begin by collecting all required files, such as your earnings statements, invoices for deductions, and any kind of various other appropriate financial documents. This organization saves and reduces errors time during the declaring procedure.

Next, familiarize on your own with the Australian Tax Office (ATO) internet site and its on the internet services. Make use of the ATO's sources, including overviews and Frequently asked questions, to clear up any type of uncertainties prior to you begin. online tax return in Australia. Take into consideration setting up a MyGov account connected to the ATO for a streamlined filing experience

In addition, make the most of the pre-fill capability used by the ATO, which automatically inhabits some of your details, minimizing the chance of blunders. Ensure you ascertain all entries for accuracy prior to submission.

If issues emerge, do not hesitate to speak with a tax obligation specialist or make use of the ATO's assistance services. Adhering to these pointers can lead to a successful and hassle-free on-line tax return experience.

Final Thought

In conclusion, submitting try this site an online tax obligation return in Australia can be streamlined through careful prep work and option of ideal resources. Inevitably, these methods contribute to an extra reliable tax obligation filing experience, streamlining economic management and enhancing compliance with tax obligation responsibilities.